“Women have different needs when it comes to their finances. They have different sets of pressure on them.” — Andrea Brimmer, chief marketing and public relations officer, Ally Financial

Ally Financial launched 10 years ago, the first major player in the realm of all-online banking. Today, it’s a Fortune 500 company, offering a full range of banking services. Andrea Brimmer, Ally’s chief marketing and public relations officer, recently spoke to SheReports about attention-getting marketing and how banks talk to women.

Ally has been a disrupter in the banking world. Do you also see yourself as disrupting banking marketing?

We’re in a category that’s ferociously competitive from a marketing standpoint. The category spends about $4 billion a year, and our share of voice of that is less than 2 percent. We don’t spend like the big banks, so we have to be extremely disruptive. We’ve done some really interesting and cool things. As a result, customers really give us permission to do things that they wouldn’t accept from other banks.

You seem to really be like the big, attention-getting activations.

We’ve done some really cool things. But they’re all centered around the idea of money mindfulness. Getting people to think about their savings. Getting people to think about their money in a different way. Getting them to really understand the higher value of money.

We did a program we called Lucky Penny, centered around the idea that a penny saved is a penny earned. We pushed out a bunch of content with fun facts about pennies, and then we hid 10 pennies in 10 cities across the country. Each was an Ally Lucky Penny. We pushed out clues as to where those pennies were hidden, and we created a scavenger hunt. If you found one of those pennies, it was worth $1,000. And you were automatically entered into a drawing where we selected a winner who won $10,000.

We’ve done some really cool things. But they’re all centered around the idea of money mindfulness.

We did something really interesting this year around the Super Bowl. We created a virtual reality app, a game that could only be played during the commercial breaks. You literally held up your phone or your tablet to the television, and it allowed you to play our game, which we called The Big Save. You input your savings goal, and then during the commercials, dollar bills would rain down from whatever room you were in. You had to catch as many dollar bills as possible and put them into a virtual piggy bank. Then we selected the top 15 scores during the Super Bowl, and we granted the savings wishes of those people.

Do you have specific strategies for targeting women consumers?

We absolutely do. Women have different needs when it comes to their finances. They have different sets of pressure on them. They’re dealing with different things than their male counterparts. We do a number of things, from a content standpoint, through the influencers that we use, through our media targeting and through the different kinds of things that we sponsor.

If you look at our advertising and marketing, we’ve always been very diverse. We’ve always been very inclusive. I like to reflect the world that we live in. We use all of our own people in our advertising. What you see are all Ally employees. It’s a great cross section, agewise, male, female, diversity, body sizes. It is the people at Ally who are doing things the right way. I think it really makes it more authentic in terms of bringing to life the promise of what the company is all about and the commitment that our employees have towards helping customers.

Women have different needs when it comes to their finances.

One of the findings in the A+E Networks Women & Money report was that women receive much less formal instruction about personal finance than men do. Is that an opportunity for banks to reach that audience?

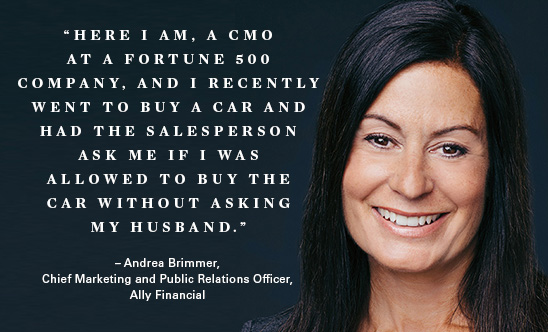

Even in the year 2018, women are still treated differently. Even me. Here I am, a CMO at a Fortune 500 company, and I recently went to buy a car and had the salesperson ask me if I was allowed to buy the car without asking my husband. We’re one of the largest auto lenders in the country. We work with dealers all the time to make sure that their sales staff is smart about the kind of interactions that they’re having with women. We are doing different things from a thought leadership standpoint. From a research and content standpoint, to push that out not only to our dealers, but to make sure that our entire associate base is trained and versed in being able to deal with women in a way that provides them the right kind of information.

Another interesting finding was that emotional associations that women and men have with money are very different. Money makes men feel confident, proud, powerful, things like that, while it makes women feel confused, fearful, guilty. What’s the solution to that?

Here I am, a CMO at a Fortune 500 company, and I recently went to buy a car and had the salesperson ask me if I was allowed to buy the car without asking my husband.

I think women need to educate themselves, and they need to feel more comfortable. We’ve made a commitment, particularly in our storefront experience, to not have any confusing jargon. When there’s regulation-speak that we have to have in there, we’ve created something called the “dejargonator,” so that when you come across a confusing term, you hit the dejargonator as you scroll over that term, and it explains in simple English what that means.

The second thing is really having confidence in yourself while you’re transacting, knowing that you can do it by making sure you’re reading the right kind of content. Realizing there’s no such thing as a dumb question. Most good financial services companies, they want you as a customer. We don’t mind questions. We don’t mind giving people the information that they need. We prefer a well-educated customer. I think women just need to have the confidence to ask those questions and not be embarrassed.

More From the April Finance Issue of SheReports:

- SheReport: Need to Know About Money

- SheReport: How to Talk About Money

- SheReport: Providing Tools and Advice to Build Trust

- SheReport: Feeling Bad About Money

- SheReport: Getting Funded by Doing Good

- SheReport: Ending the Pay Gap